The Emergence of Fast Fill Commerce

Estimated Read Time: 4 Minutes

Are “Dark Stores” the store of the future? Our research indicates the answer is an unequivocal sometimes. But for starters, the lexicon is all wrong. If this is the commonplace term used to define the new future of commerce, it’s a dismal one and demands to be rebranded with more positive and hopeful language. Technically, these are traditional retail stores converted to operate as fulfillment centers for various retail categories that increasingly lack the distinct role they once played in the lives of consumers: grocery stores, specialty, home improvement retailers, etc. And the future of commerce must be better than the somber vision the term “dark stores” brings to consumers’ minds.

Regardless, our research findings are instructive for conceptualizing this new future. For starters, there is increasingly widespread acceptance of this hybrid model for commerce.

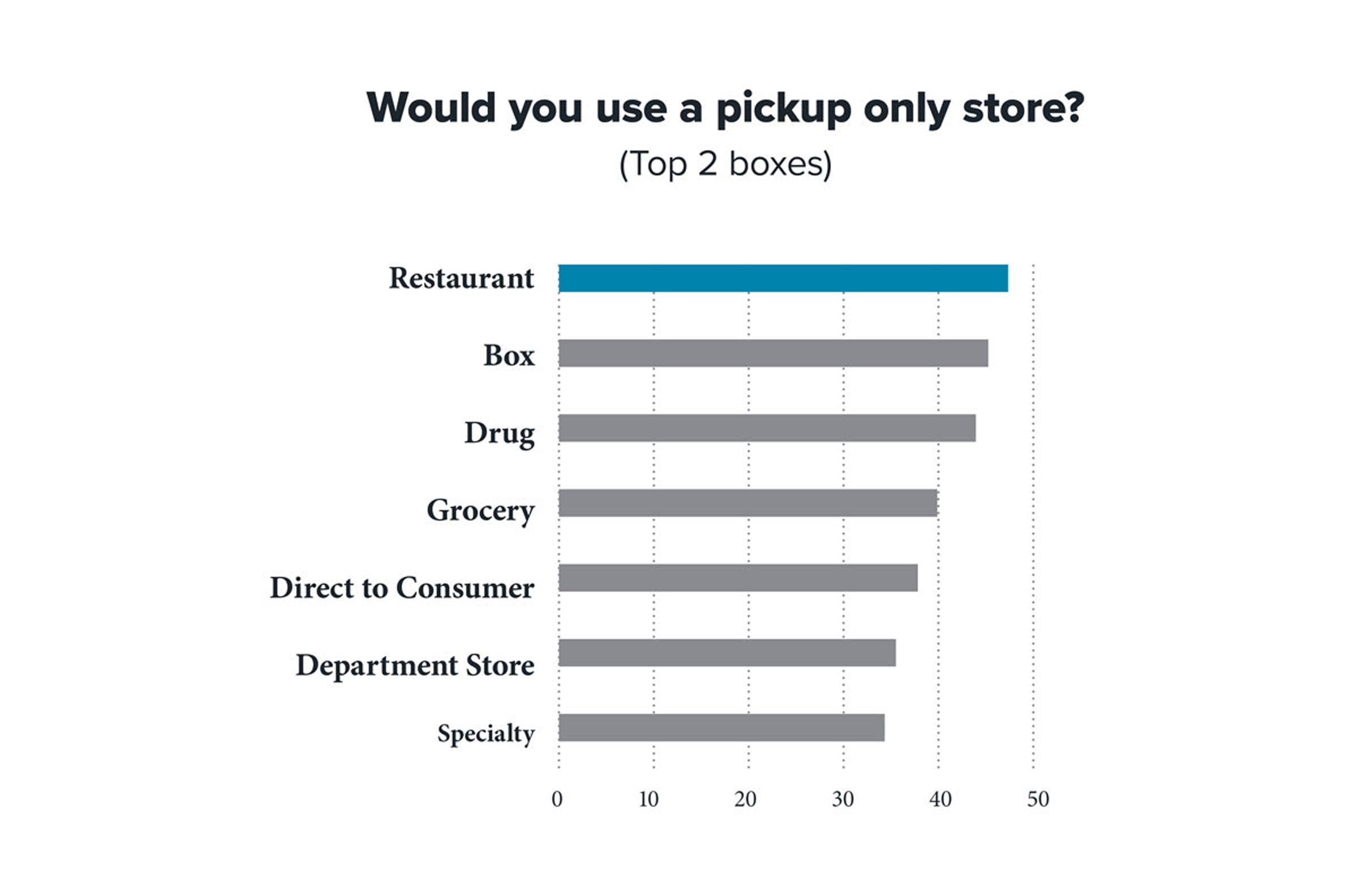

The widespread acceptance among consumers—more than 40% to “dark” restaurants, followed closely behind by Box, Drug and Grocery. Nearly half of the respondents would gladly embrace a “pickup only” model. Sure the great accelerator (COVID-19) is likely a driver of this response, but so is the way consumers are shopping as more and more consumers are turning to digital first as a means to solve their shopping dilemma, experience, and need.

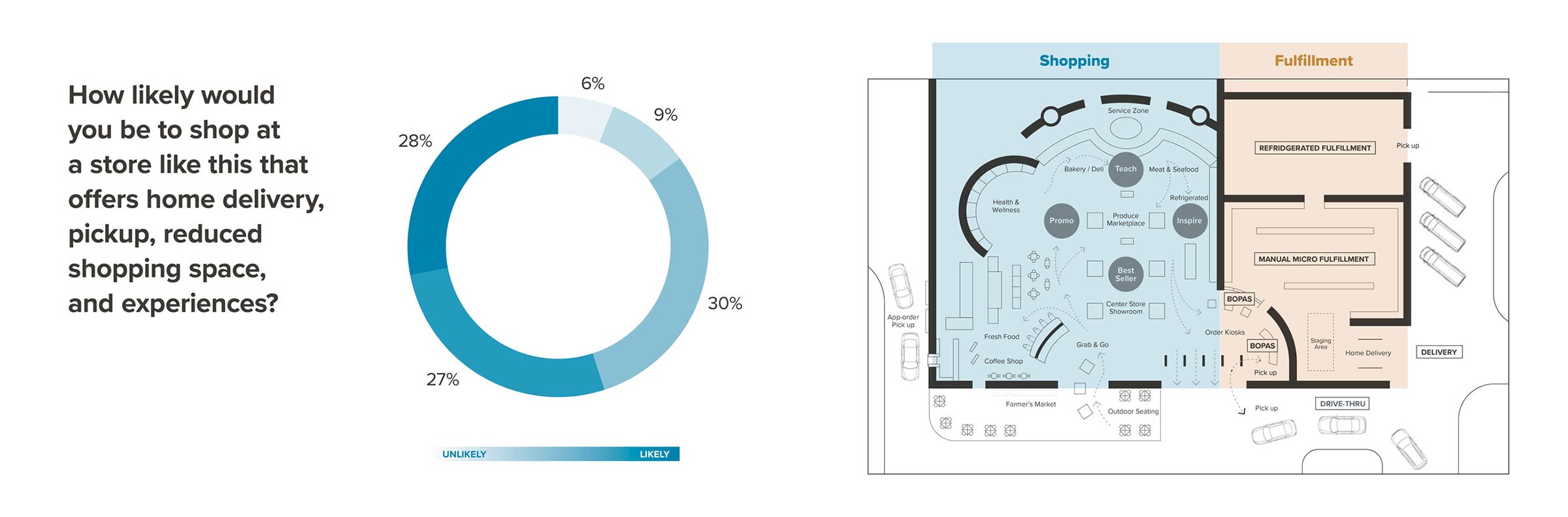

When we presented consumers with images of a well-designed and exemplary hybrid store as an alternative to dark stores offering the option of a space with traditional in-store shopping spaces as well as delivery, BOPIS and BOPAS, acceptance was shockingly high.

We showed respondents a schematic of a futuristic design of a grocery unit. This hybrid unit offered a limited floor space for shopping. Yes, you can go inside and grab a cup of coffee. You can even attend a cooking class. But you cannot hand-pick every item you want from the store shelf. Someone else will do this for you in a showroom scenario, then converted to BOPAS. That’s a significant break from the staid, uniform prototype of the 20th century store. Perhaps, not surprisingly, consumers—even when only presented with a floor plan—embraced this new model of commerce and modern consumer convenience.

While only about 28% fully embraced this model, saying that they were “very likely” to shop at such a location, the next two boxes reflect a latent affinity for this futuristic option: Nearly 28% said they were somewhat “likely” and 30% said they were likely to shop such a location.

When you add those three respondent categories together, what you have is practically the entire market of consumers—with nearly 86% of shoppers extremely open-minded and ready to trail this new model for commerce. The willingness to embrace an entirely new model of shopping deserves attention. Indeed, this is a staggering finding—and a solid foundation on which to build a new location strategy for many brands.

It’s important to put such findings in perspective. How should many brands and retail categories interpret these potentially devastating changes in consumer behavior?

When we return to a semblance of normalcy, it will undoubtedly be an unrecognizable new era for commerce and consumer culture. But some things won’t change.

Brands and retailers must still shape a competitive trajectory and a brand identity. They must define themselves as relevant in the marketplace and give consumers what they want, and more importantly, how they want it even if they’ve forgotten they still want it.

A few benefits to brands for implementing a Micro Fulfillment Center:

- Localized data and inventory

- Rapid decrease in cost of last mile

- Faster delivery times

- Faster order fulfillment overall (BOPIS)

- Improved customer retention

How to move forward

A portfolio model of fast-fill commerce and destination spaces

There is no singular store model of the future—there are many.

The winners of this new era of commerce will be those brave enough to embrace a strategy that’s multi-faceted, flexible, adaptable, and creative. There will no longer be a set-in-stone, singular model to scale a brand’s store footprint. There is no “model” store of the future you must build in every city. No exemplary model that will work everywhere. There are many

That means, in order for a physical fleet to succeed, accepting the fact that you must have a customer-focused portfolio of options at the ready:

- Fast-fill commerce spaces that embrace and allow for exciting and different experiences as well as BOPIS, and delivery.

- Fast-fill commerce spaces that are BOPIS-and delivery only.

- Spaces that are destinations built entirely around experiences that create contextual value and your own set of influencers.

- And finally, room for commerce spaces you haven’t even dreamed of yet.

The delta between where we are now, and the above set of customerbased physical spaces, is not as wide as you may think. Target, Best Buy, and Walmart have devoted their powers to similar strategies and the results are in this paper as well as their quarterly reports. The time to act is now. Hopefully the information we’ve shared here will provide you with the impetus to move quickly. And given our devotion to this industry, we’d love to help. Ready to define your brands’ future? Reach out to us at talkwithus@wdpartners.com.