From Place to People: It’s Time to Reinvent Outpatient Specialty Health

Estimated Read Time: 5 Minutes

Surging Outpatient Growth

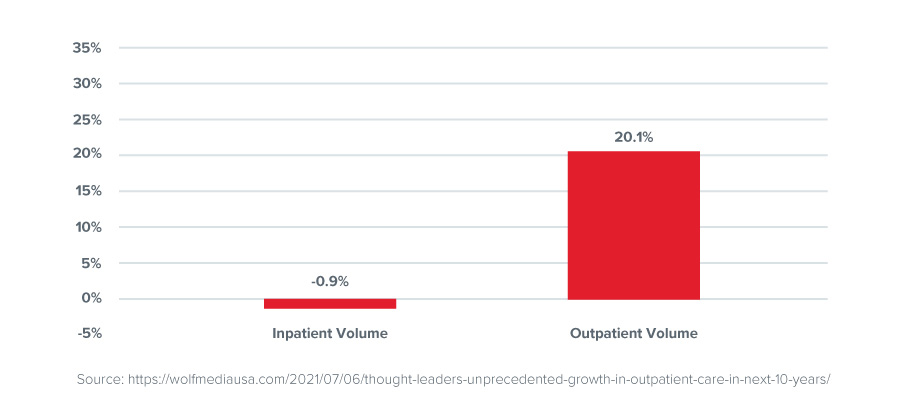

When one thinks of healthcare, the first image that comes to mind is the towering hospital, a fixture in countless communities. In fact, that is also the first image many healthcare leaders have too, as it has traditionally been the driver of hospital revenue and profit. Yet, a transformation is underway. While hospitals have long been the stalwarts of healthcare revenue and profit, the landscape is shifting. Over the years, hospital construction has dwindled, admissions rates have plateaued, and outpatient visits have surged. The forecast for hospital visits is on a downward trajectory until 2030, while outpatient volumes are expected to soar by over 20%!1

Unsurprisingly, this seismic shift has propelled outpatient visit revenues to constitute more than 50% of the average health system’s income.

Why the Shift?

Several factors underpin this surge in outpatient facility usage:

- Technology Advancements – Cutting-edge technologies enable safe and efficient procedures, often allowing patients to leave on the same day.

- Consumer Demand – Patients seek convenience and superior experiences in healthcare, gravitating toward accessible locations.

- Cost Efficiency – Outpatient centers are cost-effective to establish, maintain, and staff, yielding significant savings–up to 40% less than the same procedures at traditional hospitals2. Adding to the savings is the increase in procedures eligible for reimbursement and the potential for value-based payment.

- COVID-19 Impact – The pandemic prompted people to avoid hospitals due to infection concerns, favoring less congested and perceived safer outpatient settings.

- Demographic Trends – Three quarters of the US population growth between 2020 and 2030 will be in the over 65-year-old segment, which is responsible for nearly 80% of healthcare expenditures3. Increased healthcare needs and visits, along with continued trends of the above factors, bode well for continued growth in outpatient facilities.

Read: Healthcare for an Aging America

Not Just Location

While convenience is a significant factor driving outpatient choices, unlocking the full potential of outpatient growth entails considering numerous variables According to Emily Connelly, Senior Consultant, Health Care Advisory Board:

To truly appeal to consumers, outpatient providers must craft a unified value proposition centered on the individual’s needs. Many systems claim to be “patient-centered,” but is that the reality? Are you really building the entire experience with the consumer in mind or simply locating service lines closer to your population? Consolidating specialties into large medical buildings may be efficient but may not serve consumers’ best interests in the long run. To achieve consumer-centricity, healthcare systems must transcend mere proximity and design the entire experience with the consumer in mind.

The Rise of Specialization

In retail, “category killers” transformed the industry by specializing in specific consumer needs and delivering comprehensive experiences. Think of The Home Depot, Dick’s Sporting Goods, Ulta, and many other large format stores that specialize in a specific area of consumer purchase and need and deliver a complete experience to signal their expertise and category dominance in that area. These formats grew rapidly and stole huge market share from the Sears, JCPenneys, and department stores of the day, as well as smaller, fragmented industry players. The consumer attraction was obvious, with huge inventories, specialized knowledge, and an entire physical environment and experience that envelops the consumer in that category, inspires them to buy more, generates a community of like-minded consumers, and creates category and brand loyalty.

Likewise, specialty health concepts could have the opportunity to be a “category killer” for healthcare. We are already starting to see the signs of this specialization in heart care and cancer care, with at least a grouping of experts, if not an experience built for those consumers. Many other specialties may have similar potential, such as:

- Sports Medicine

- Women's Health

- Men's Health

- Dermatology

- Allergy

- Sleep

- Pain Management

It is one thing to place all specialists into one building, attach a sign and call it a specialty center. It is totally different to build an entire experience, both physical and digital, around the needs and interests of targeted consumers, and adding products, solutions, coaching, and distinct exterior and interior stories to support and inspire those consumers. They do not have to be large either. Lululemon and Sephora have been rather successful at creating category dominance with smaller facilities. While these concepts could be placed in specific markets with known need, they could also be grouped, not so much in a large tower, but perhaps a center that looks and feels like today's "town center" shopping areas. What retailers learned long ago is that being generic and broad is dangerous without dialing up another dimension such as superior price position, service or other variables of value to targeted consumers.

Innovative concepts, often backed by private equity investors, are starting the march toward becoming the category killers of various segments of healthcare. One example is Tia (https://asktia.com), a health experience designed exclusively for women. Tia offers primary, mental health, gynecological care, and evidence-based wellness services in an integrated and seamless model, redefining women’s health. The facility is beautifully designed and clearly communicates it’s focus on women.

A Holistic Experience

Outpatient environments are defined by the walk-in, walk-out nature of care. Consumers visit frequently, making the patient experience paramount. To differentiate and capture market share, providers must deeply understand their target consumers, shaping a holistic experience that creatively addresses their perceptions, emotions, and behaviors at every touchpoint.

In a competitive healthcare market, organizations must not only brand their overall identity but also consciously design superior experiences tailored to specific consumer communities and their unique needs.

…And a good location helps too.

Take Steps Today

Private equity-backed concepts, retailers, and aggressive, innovative systems are moving quickly to develop new outpatient and specialty health models. The time to act is now, before market competition forces your hand.

WD Partners is fully equipped to guide your teams through this transformative journey.. From strategic insights and concept development to innovative brand design and experiential environments, we can help you create a differentiated outpatient program that not only stands out but also captures market share. Let’s embark on this journey to revolutionize outpatient specialty health.

If you’d like to discuss more with our Health + Wellness Expert, Dan Stanek, please contact him at dan.stanek@wdpartners.com

Learn more about how WD can help innovate and scale your practice and then talk with our Health and Wellness practice leader, Dan Stanek, to get started.

Dan Stanek

Dan Stanek