What Concept Would Increase Your Visitation to a Mall?

Unveiling Consumer Preferences and Innovative Concepts for Tomorrow's Shopping Spaces

Estimated Read Time: 4 Minutes

Malls Are on Life Support: Not So Fast

In the realm of retail, malls have faced significant challenges, especially with the rise of digital commerce. If you have been with us throughout the past few years, you know that we have been following the state of physical retail in the face of an e-commerce explosion. We have done our research, analyzed the data, and brainstormed more revitalization ideas than we could count, but nothing could have prepared us for the one thing that no consumer survey could’ve seen coming: COVID-19. (We know, you’re sick of hearing about it, talking about it, and thinking about it. But keep reading. It’s worth it.)

Though it seems like the pandemic truly disrupted every facet of our daily lives, we see things a little differently through our less-than-rosy retail lens. The pandemic has been an accelerator, not a disruptor, especially for physical retail and mall stores. For example, store traffic was down and now it’s gone; vacancy rates were off, and now they’re off the charts; e-commerce was good, but now it’s a must-have; Walmart and Amazon were dominating, now they make up a third of retail sales; delivery was a nice-to-have, now it’s essential. Because of all these disruptions and accelerations, the retailers that were barely surviving are now officially bankrupt (especially department stores). Consumers are less inclined than ever to shop in person, so what comes next? How can we revive physical stores to bring back the (socially distanced) crowds?

In the midst of the 2018 mall decline, we conducted a survey to answer this exact question in a very different retail climate. Now, we decided to conduct the study again but this time, in a post-pandemic world. We asked over 2,200 consumers what it would take to bring them back to physical stores, and spoiler alert: the results are even stronger the second time around.

Understanding Consumer Preferences and Digging into the Data

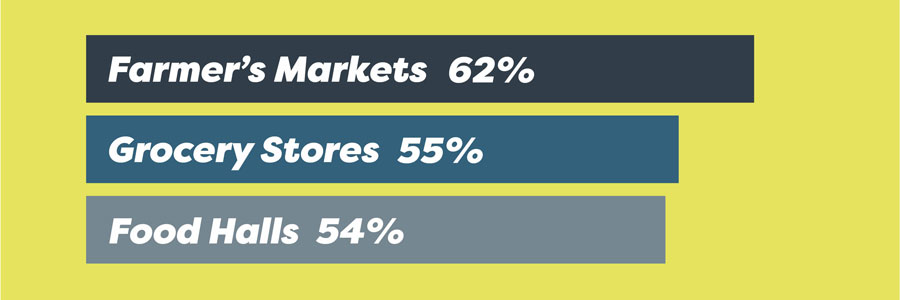

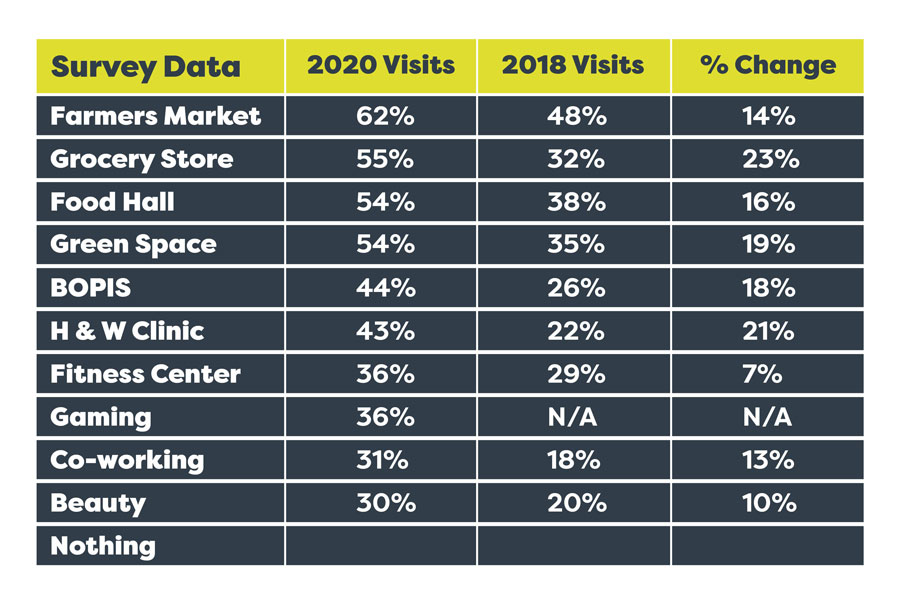

One crucial question we asked was, “What concept would increase your visitation to a mall?” Every option but one scored double-digit increases from the 2018 results, and it is evident that consumers are showing a stronger sense of urgency for spaces (especially those vacant department store venues) to change into something more useful and desirable. What concept was the most popular? In both studies, we saw two main themes: food and wellness. The top three concepts in our latest study were food-based, with farmer’s markets coming in at 62%, grocery stores at 55%, and food halls at 54%. This differs slightly from the 2018 results as grocery flew up to the number two spot in the current market. Nevertheless, there is a call to action that lies in the fact that these results, which are even stronger than previous ones, have remained consistent. We have confirmed time and time again that customers will visit physical retail if food is present in some shape or form, so now is the time for retailers to make the switch.

The Importance of Wellness, Safety, and Green Spaces

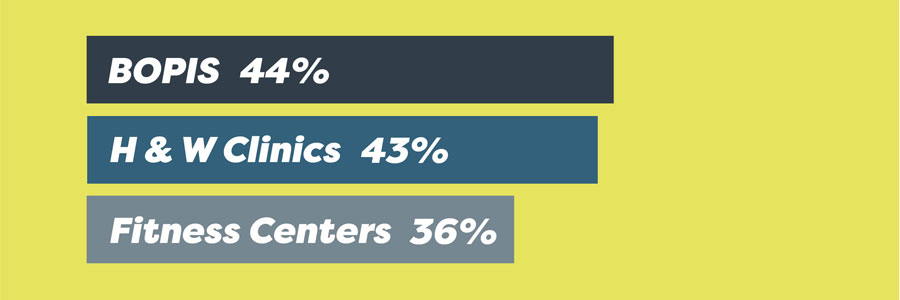

The next three top-ranking concepts fall into the wellness and safety space; given the current public health crisis, the increase in consumer preference towards these theories is very apropos on account of concern for touchless purchase options along with maintaining good health. An all mall BOPIS options came in at a 44% preference, with health & wellness clinics at 43% and fitness centers at 36%. Speed, convenience, and the need for touchless have driven BOPIS numbers to new heights for all retailers and restaurants as it was truly the only option for many consumers at the height of the pandemic. And as we all know, a trip to the clinic for routine testing has become a part of our new normal. When it comes to fitness, the huge increase is logical as consumers have taken their time off to focus on self-improvement because let's face it: what else is there to do?

One high scoring concept that was unlike the rest was green spaces. This idea is centered around creating a park-like environment, either in or outdoors, that consumers can use for relaxation, public performances, or gatherings. Green spaces scored 54% this year, improving on its already high standing from 2018 because when all else fails, people would rather congregate in a nice, natural environment rather than the empty space that is currently being offered.

Analyzing by Demographics

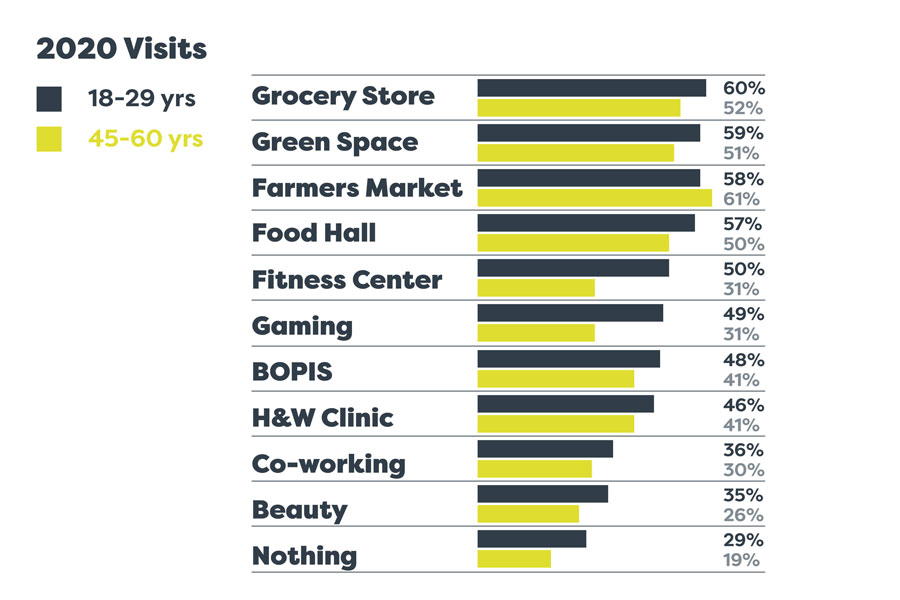

Breaking the numbers down by age offers another layer of insights to the data.. In our first study, we found that food concepts could bridge the gap between younger and older generations. Today, we found that sentiment still holds; younger consumers may be more receptive to a variety of concepts, but there is no doubt that both groups would emphatically welcome a food-based reinvention.

The most notable difference is seen between Digital Natives (18-29) and Digital Immigrants (45-60), with Natives starkly contrasting the opinions of the Immigrants. Based on the top two box scores for driving more visits to the mall, all concepts but the farmers market were rated higher by the younger demographic. When looking at which concepts had the largest percentage spread, fitness centers (19% spread) and gaming (18% spread) were the ones to watch; this division is to be expected as the younger crowd has more affinity for gaming and self-care.

Key Recommendations for Mall Reinvention

These four tips need to be seriously considered today in order to maintain relevancy tomorrow, so it is now time to ask: what’s next?

- Embrace Food: Food is a winner. Implement it now.

- Two studies, two years, one pandemic, same results. We now know that some or all forms of food as a replacement for empty space or simply as crowd-drawing additions are a win-win. The longer we go without these spaces, the longer the customer gets to fall more in love with home delivery and digital options. There is no better time than the present to consider how to make this concept work for you.

- Prioritize Wellness: In health and wellness, touchless and popups are here to stay.

- The large increases in support for these categories are undoubtedly relevant to the times, but in two separate years, they scored strong and will continue to do so for the foreseeable future. There isn't much of a downside to any of the scores in this group, showing that it is a viable option for mall revitalization.

- Experiement Boldly: Embrace the new and fail fast.

- The group of new concepts (gaming, co-working spaces, and beauty supply stores) may not be the food-like panacea we're all looking for, but the idea that almost a third of those studies liked the ideas enough to score them high is an indication that there is consumer interest. Keep studying, keep trying, keep adapting.

Related: How the Test and Learn Approach can De-Risk Your Idea and Guarantee an ROI

- Enhance Green Spaces: Greenspace, nuclear option.

- When and if all else fails, giving the customer a nice place to rest that isn't the grimy food court of malls’ past. Natural areas will beat out hard plastic seats any day.

The Journey Towards Mall Revitalization Begins Now

Interestingly enough, the ‘none option’ (i.e.; I don’t want to see anything new in my malls, I’m giving up on them) in this study came in at 24%. But in 2018, that number was up at 28%; this shows that, even though the gap is small, the idea of shopping at physical retail spaces is not headed to extinction. With a little exploration, trial and error, and a whole lot of innovation, consumers are open to seeing if retailers can bring the mall back and make it better than ever.

Want to see the complete report? Download the full study results here.

Lee Peterson

Lee Peterson